Tax is a tricky business.

I wanted to update this post as being self employed for the last good few years has definitely been a learning curve when it comes to being responsible for your own accounts and tax returns.

I wrote this post back in 2013 after a group discussion and a few chats with my closest blogger pals, I realised that this could be valuable information for those confused, overwhelmed, or curious. I am not a financial adviser but I have pulled this information from the Government's website. I just thought it would be easier to have a checklist in one place instead of scrolling through lots of pages.

I had done the usual searches and could only find information specifically related to blogging on American sites from other bloggers trying to help each other.

Unfortunately our tax system is completely different to the US, so I thought I would write a simple post that may help anyone else with the same queries I had.

I have attended a couple of blog conferences this year and at each they talked about how to promote your blog commerically and the sessions on how to monetize your blog, seemed to all be really well received. At BritMums Live there was a session on Accountancy (you can see the slides here) which took those who attended through the basics of what you need to know when it comes to setting yourself up as self employed if your intention is to make some money from your blog.

I completely missed this session and, of all the many posts I read following BritMums Live, I didn't hear a whisper about it. The follow up post is great and really helpful, so do read it.

I feel that there is more emphasis on how to make money from your blogs, rather than the implications of making money from it.

At the Blog Summit event the advertising program was promoted at the start of the session with an informative speech from the PR company.

But I think the implications of earning money from your blog should be as heavily promoted.

I am not a tax expert, but I am self employed as a consultant in the development industry, a part time photographer and blogger, and I know that you have to declare ANY income you receive.

HMRC state quite clearly that if you earn any money from temporary or part time work you must declare this income, even if it is below the current threshold for income tax.

The current annual threshold is £9,440. This is the maximum you can earn in total before you are liable to pay tax.

UPDATE: Following a reader's comment, it's important to realise that this threshold is the total amount of income you can earn. If you blog as a second, pocket money income and are employed, you should get advice from your local tax office. If you pay your tax through your employer, then all your blog income could be liable for tax.

Whilst "blogger" is not defined in the list of situations where you are classed as self employed, you need to decide whether you think that being a part time, full time or every now and again blogger, who earns some sort of income from their blog, falls into the self-employed category.

Possible next steps:

- Register for self assessment online. You can do that here.

- Apply for a Certificate of Small Earnings Exception from National Insurance contributions if your profits from your blog are less than £5,965 (as of January 2017). Or you can opt to pay Class 2 contributions.

- If your profits are more than this you will be required to pay your own National Insurance contributions. Further information on this is available here.

- Ring your local tax office or Citizens Advice Bureau if you have any queries, including any regarding deductible expenses.

- Organise all your blog related financial documents including invoices, print your PayPal statement if you use PayPal as a form of payment and any receipts from expenses you have incurred through your blog.

Keeping a good record is essential. There are a number of expenses you can deduct from any potential taxable income.

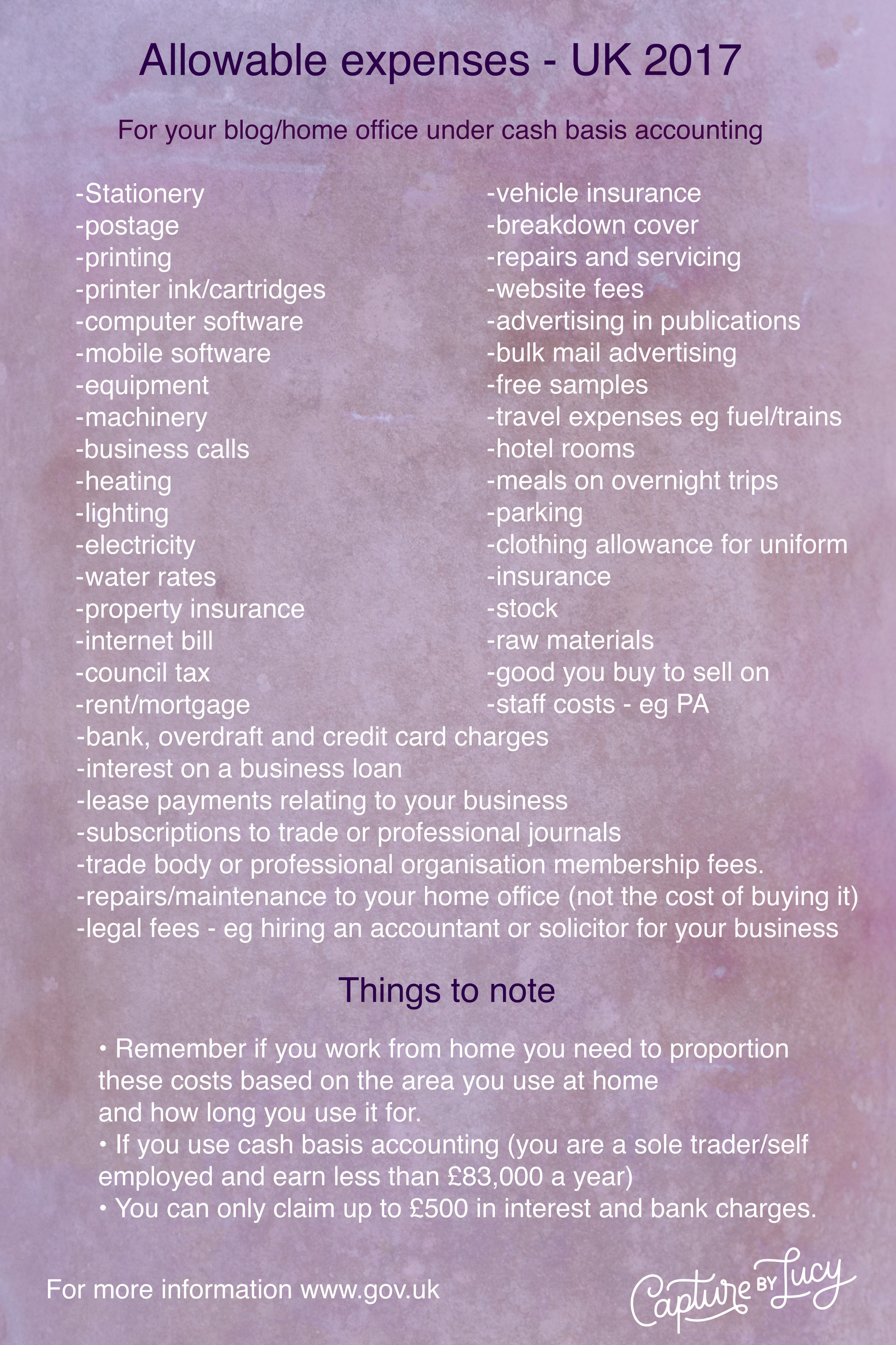

Here is my updated list for 2017

These are listed on the Government website as allowable expenses if you are submitting your tax return under the cash basis accounting system. This applies if you earn less than £83,000 from your self employed/sole trader business.

All the information you need to work out what expenses are allowable are here.

Invoicing

Always invoice a company you work with on your blog. This can be a simple Word or Pages document.

Points to include on an invoice are:

- Date

- Invoice Number

- Company

- Contact name, number and email

- Reference (Describe the work i.e. sponsored post/advert/competition)

- Amount due

- Date payment is due by

- Payment Method

- If you are invoicing for an advert you may want to include whether the artwork is supplied and what size).

This is not a definitive list and do let me know what else you include so we can share information.

I am of the mindset that if you want to run your blog professionally, (if you want to earn an income that is is - not everyone does!) that corresponding with and invoicing companies in a professional manner is good practise. No matter how much you may earn.

The same applies for any adverts you run on your blog that you receive an income for.

This is not official advice from HMRC. I would like to highlight again that I am not an accountant nor a tax expert!

The deadline for paying your tax for the year ending April 2016 is 31st January 2017.

There is loads of advice on line at gov.uk.